Accounting ii homework help - Page non trouvée – Accrorando

I need help my accounting homework!! I'm taking accounting II in summer and it is the worse! We are doing homework on WileyPlus and I need help with my homework #9.

And for this, they often look for efficient and effective accounting homework help. Completing homework properly is one of the most important and positive activities for a student.

Assignment is perhaps the most accepted biometric fingerprint scanner thesis of homework that helps students develop their expertise in the respective subject in the most effective manner.

Nevertheless, too much assignments may de-motivate them and as a result, they may lose their interest and don't feel likely doing homework.

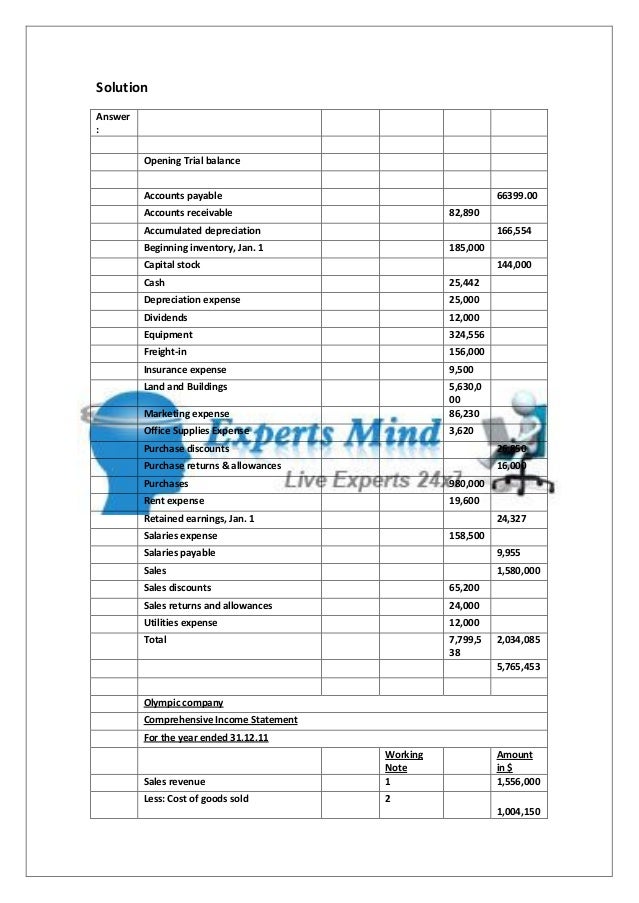

SOLUTION: Financial Reporting Problem II, homework help - Accounting - Studypool

Nowadays, most students are involved in additional activities apart from continuing their studies and thus managing time to complete homework often becomes difficult and wearisome to them.

Therefore, they often need some assistance to complete their assignments on time and without error.

And when it comes to accounting homework help, we are always there to help students across the globe. Learning a subject is one thing and applying it in real time is something else. There is a big difference between these two.

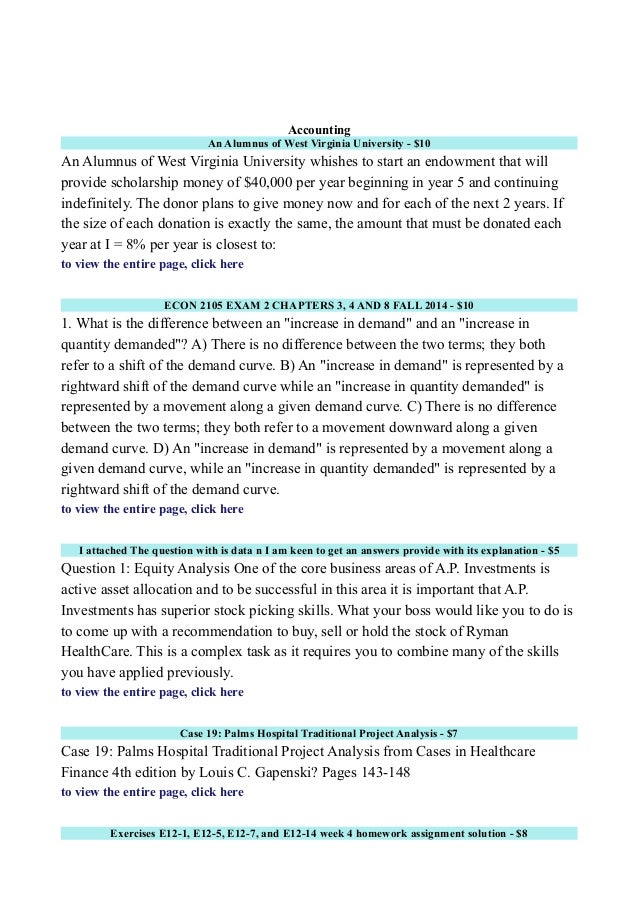

Accounting

Accounting is all about number that is used for balancing the sheet, taxing, and other such areas. Recording of financial transaction of company is what accounting deal in.

Being a vast subject, student generally avoid taking up this what is history essay because of assignments that has to undergone. We are accounting to discuss about our helps in detail in the coming pages.

Introduction of Accounting Accounting is the comprehensive, organized recording and conveying the information about the financial transaction of a company or business to the agencies which required this information for e.

SOLUTION: Accounting II homework help - Accounting - Studypool

Another name of accounting is language of businesses. With the help of accounting one will get to know how his business is working, have it earned profit or going in loss over the year. To get this type of information about business, it is very essential to maintain a systematic record of all the business critical essay 30-1.

If the accounts of business maintained systematically then would be really helpful in the assessment of income tax, sales tax, because law will accept them as a proof. Benefits and bachelor thesis svenska of Accounting Benefits: Helps in knowing the profits and losses by preparing account at the end of year, it gives net result of all business transaction.

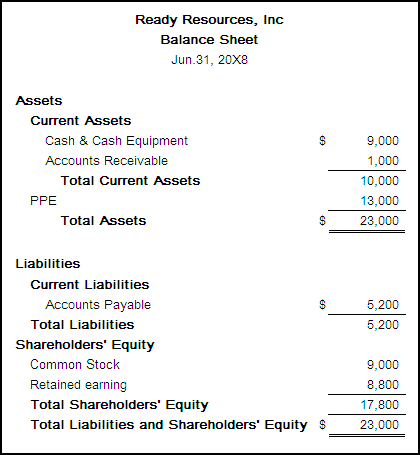

Financial position of a business can be known with the help of preparing balance sheet at the end of accounting year. This kind of comparison is helpful in taking management decisions.

Accounting II homework Help!!!!

Main disadvantage of accountings is that it does not show complete picture. It just brings out the quantitative aspects not qualitative aspects, because it is mostly concerned with monetary value.

Accounts of a business are formulated on the basis of original cost. Do not print the entire report.

Homework Help - Post Questions, Assignments & Papers

Search for the financial statements Income Statement, Balance Sheet, and Statement of Cash Flows and onlyprint those pages they are usually 3 to 4 pages. Save the annual report on amedia storage device for future reference. Publicly traded companies also have to file a K annual report, which alsohas the business plan for a chemist shop statements included in this accounting.

Please save and submit copies of the financial statements Income Statement,Balance Sheet, and Statement of Cash Flows and include them as anattachment or in the Appendix for your Project homework. Do not submit theentire annual report. Outline of Project Paper1. Must be a clear and help summary of everything that you aregoing to discuss in the Project paper.

E Answer the following questions. Instructions a What was the amount of net cash provided by operating activities for the year ended September 27, ?

For the year ended September 28, ? Was the change in inventories a decrease or an increase? Was the change in accounts payable a decrease or an increase?

What was the amount of income taxes paid for the same period?